Revolutionizing Financial Operations with Microsoft Power Platform

Enhancing Compliance, Reducing Risks, and Driving Operational Efficiency

Pain Points Faced by Finance Sector CTOs & CEOs

Leaders in the finance sector encounter several operational and strategic challenges:

- Regulatory Compliance & Risk Management – Ensuring adherence to evolving regulations and mitigating financial risks.

- Data Silos & Inefficiencies– Fragmented data across different departments hinders decision-making.

- Fraud Detection & Prevention– Growing cyber threats require real-time monitoring and intelligent fraud detection.

- Customer Experience & Retention– Slow service processes and manual workflows impact customer satisfaction.

- Operational Costs & Process Automation– High costs associated with manual financial operations and compliance reporting.

Case Study: Automating Compliance & Risk Management in Financial Services

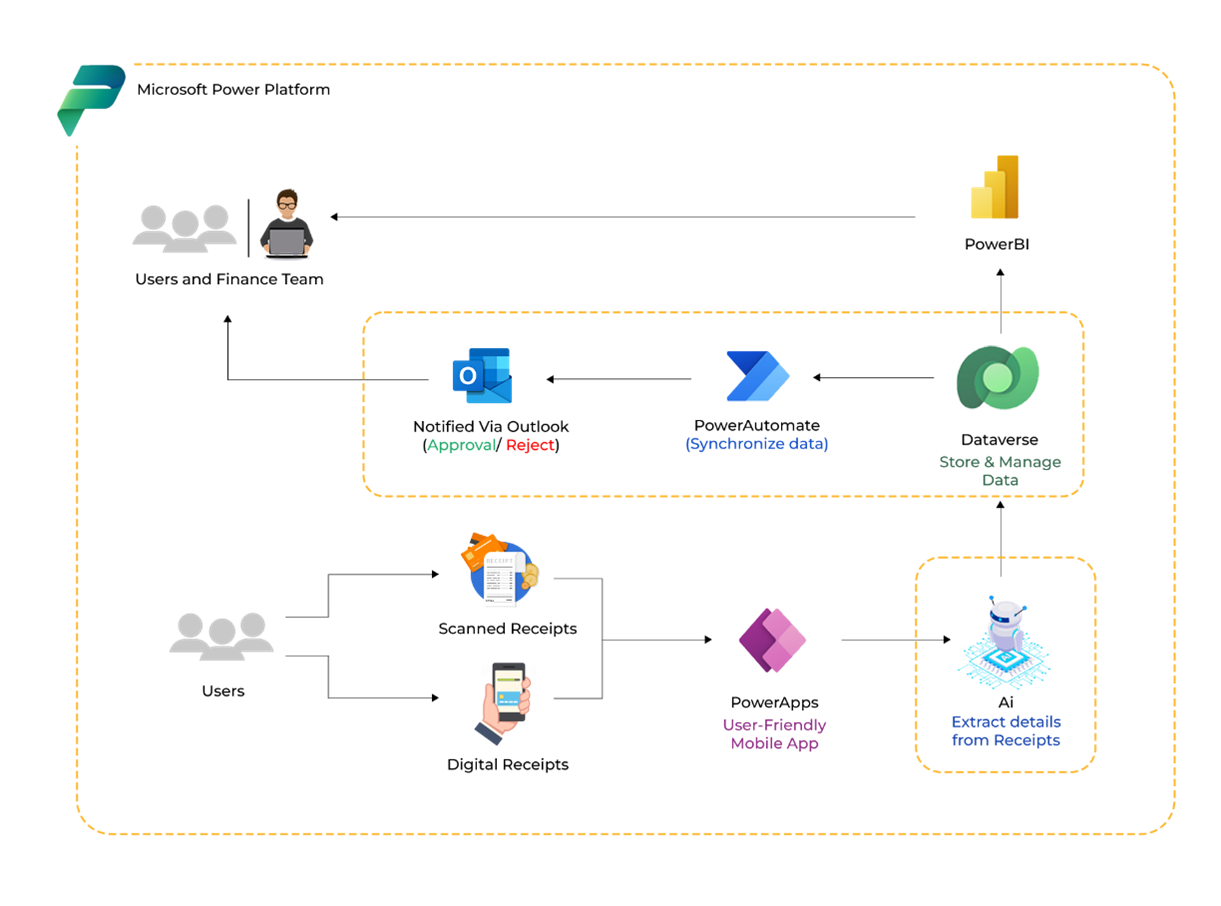

Solution Implementation

By leveraging Microsoft Power Platform, the organization transformed its compliance, risk management, and customer operations:

Power Apps – Streamlining Customer Onboarding & Document Management

- Developed a secure, mobile-friendly onboarding applicationthat automates KYC (Know Your Customer) processes.

- Integrated with AML (Anti-Money Laundering) databasesfor real-time verification.

- Result: 50% reduction in onboarding time and improved compliance accuracy.

Power Automate – Automating Compliance Workflows & Fraud Detection

- Implemented AI-powered workflowsto monitor transactions and detect suspicious activity in real time.

- Automated regulatory reporting, ensuring compliance with SEC, FINRA, and GDPR standards.

- Result: 30% reduction in compliance costs and faster fraud detection response times.

Power BI – Real-Time Risk Analytics & Financial Insights

- Deployed interactive dashboards for financial risk assessment, fraud trends, and operational efficiency metrics.

- Enabled predictive analytics to identify fraud patterns and mitigate risks proactively.

- Result: 40% improvement in risk mitigation and regulatory reporting accuracy.

Microsoft Copilot Studio – AI-Powered Financial Assistance

- Implemented an AI-driven assistant for customer service, fraud alerts, and compliance queries.

- Provided 24/7 availability for clients to track transactions, resolve disputes, and get real-time financial insights.

- Result: 35% increase in customer satisfaction and a 50% reduction in call center workload.

Impact Score: Measurable Outcomes for Retail Sector CEOs & CTOs

Metric | Before | After | Improvement (%) |

Stock Shortages | 30% | 18% | 40% reduction |

Supply Chain Efficiency | Low | High | 30% improvement |

Sales Revenue Growth | Baseline | +25% | 25% increase |

Customer Engagement Score | 70% | 95% | 35% improvement |

Support Requests | 100% | 50% | 50% reduction |

Key Benefits for Retail Sector CTOs & CEOs

- Optimized Inventory & Reduced Stockouts– AI-driven demand forecasting ensures stock availability.

- Improved Customer Experience –Personalized shopping experiences increase customer satisfaction.

- Faster Order Fulfillment–Automated supply chain workflows reduce delays.

- Cost Reduction & Efficiency Gains–Automation minimizes manual labor and operational expenses.

- Data-Driven Retail Strategy– Real-time insights optimize pricing, promotions, and stock planning.

By leveraging Microsoft Power Platform & Copilot Studio, retail businesses can enhance operational efficiency, maximize sales, and create a seamless omnichannel experience.

Is your retail business ready for digital transformation? Let’s explore how Microsoft solutions can drive your success.